Understanding the Customization Process for Corporate Stationery in the UAE

Expert Quick Answer:

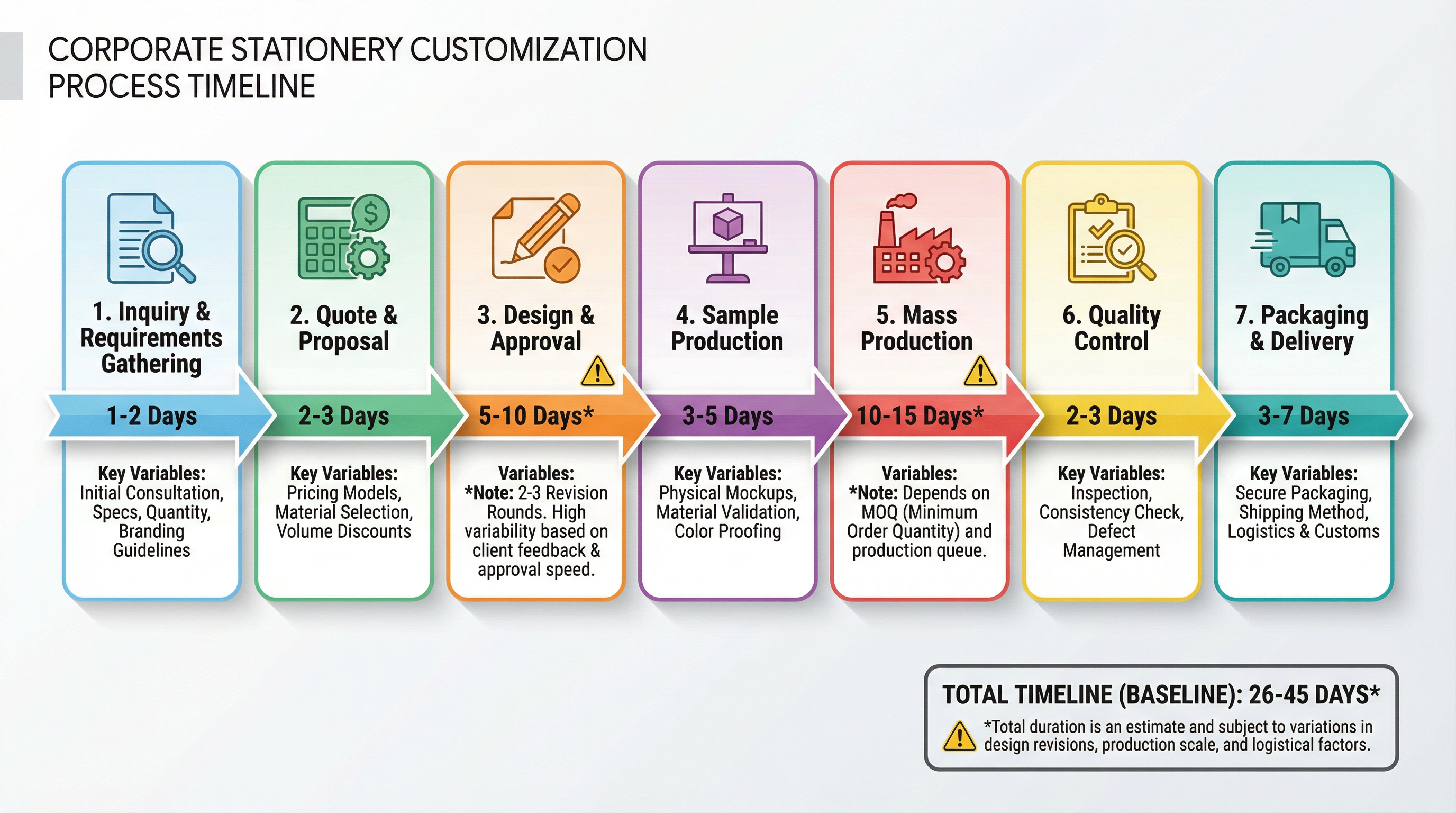

The customization process for corporate stationery in the UAE typically spans 26 to 45 days and involves seven distinct phases: inquiry and requirements gathering, quotation and proposal, design and approval, sample production, mass production, quality control, and packaging with delivery. However, the actual timeline can extend significantly based on design complexity, material availability, supplier capacity constraints, and seasonal demand fluctuations—particularly during Ramadan, UAE National Day, and year-end corporate gifting periods. Understanding these variables and planning accordingly is critical for procurement teams managing brand consistency, budget constraints, and delivery deadlines.

Why Customization Process Understanding Is Critical for UAE Enterprises

In our experience working with procurement teams across the UAE and broader GCC region, we consistently observe a fundamental disconnect between how enterprises perceive the customization process and how it actually unfolds in practice. This gap often manifests as missed deadlines, budget overruns, and compromised quality—outcomes that could have been avoided with a more nuanced understanding of the procurement workflow.

From a budget control perspective, enterprises frequently underestimate the cost implications of design revisions, material substitutions, and expedited production requests. A seemingly minor change—such as switching from standard paper stock to recycled material—can trigger a cascade of adjustments that affect not only unit cost but also minimum order quantities and lead times. We have seen cases where a 15% design modification resulted in a 40% cost increase and a three-week delay, simply because the new material required a different supplier with longer procurement cycles.

From a brand image perspective, the customization process directly impacts how consistently your corporate identity is represented across touchpoints. In the UAE market, where business relationships are built on trust and professionalism, inconsistent stationery quality or delayed deliveries can signal operational weakness to clients and partners. This is particularly critical for enterprises operating in regulated industries—such as financial services, healthcare, or government contracting—where brand consistency is not merely aesthetic but a compliance requirement.

From a regulatory risk perspective, UAE enterprises must navigate specific compliance considerations that are often overlooked during the customization process. These include customs documentation requirements for imported materials, VAT implications for cross-border procurement, and adherence to UAE Standards and Metrology Authority (ESMA) guidelines for certain product categories. Failure to address these considerations during the design and production phases can result in shipment delays at customs, unexpected duty charges, or even rejection of non-compliant goods.

The Seven-Phase Procurement Workflow: What Actually Happens

Phase 1: Inquiry and Requirements Gathering (1-2 Days)

The process begins when your procurement team initiates contact with potential suppliers. However, the quality of this initial inquiry directly determines the accuracy of subsequent quotations and timelines. In practice, we find that enterprises often provide incomplete specifications—such as "we need 500 notebooks with our logo"—without clarifying critical details like paper weight, binding method, or delivery location within the UAE.

What suppliers actually need to provide accurate quotes: specific quantities for each item type, detailed branding guidelines (including Pantone color codes and logo file formats), intended use case (which influences material selection), delivery address (as logistics costs vary significantly between Dubai, Abu Dhabi, and remote emirates), and target delivery date. The more precise your initial inquiry, the fewer revision rounds you will encounter later.

Phase 2: Quotation and Proposal (2-3 Days)

Suppliers evaluate your requirements against their production capabilities, material availability, and current capacity constraints. This is where minimum order quantity (MOQ) considerations become critical. For standard items like notebooks or business cards, MOQs typically range from 100 to 500 units. However, specialized materials—such as vegan leather covers or metallic foil stamping—often require MOQs of 1,000 units or more due to setup costs and material procurement minimums.

A common misjudgment we observe: enterprises assume that quoted prices are fixed and comparable across suppliers. In reality, pricing structures vary based on whether the supplier manufactures in-house or outsources production, their current capacity utilization, and their payment term requirements. A supplier offering 30-day payment terms may quote 15-20% higher than one requiring 50% upfront deposit, reflecting the cost of capital and credit risk.

Phase 3: Design and Approval (5-10 Days)

This phase exhibits the highest variability in our experience. While suppliers typically include two to three design revision rounds in their base pricing, the actual number of iterations depends heavily on internal approval workflows within your organization. For enterprises with centralized brand management, approval may take 3-5 days. For multinational corporations requiring sign-off from regional headquarters, this phase can extend to 15-20 days.

The hidden cost of design revisions: each additional revision round beyond the included quota typically incurs a fee of AED 500-1,500 per item type, depending on complexity. More critically, design changes after sample production has commenced can trigger complete production resets, adding 7-10 days to the timeline and potentially requiring new material procurement.

Phase 4: Sample Production (3-5 Days)

Physical samples allow you to validate color accuracy, material quality, and finishing techniques before committing to mass production. However, sample production timelines are often underestimated. For items requiring specialized techniques—such as embossing, foil stamping, or custom die-cutting—sample production may require 7-10 days as suppliers need to create custom tooling or plates.

A critical decision point: some enterprises skip sample production to save time, proceeding directly to mass production based on digital proofs. While this approach can reduce lead time by 5-7 days, it significantly increases the risk of color mismatches, material quality issues, or finishing defects that only become apparent in physical form. We generally recommend sample production for orders exceeding AED 10,000 or involving new suppliers.

Phase 5: Mass Production (10-15 Days)

Production timelines are directly influenced by order quantity and supplier capacity utilization. During normal periods, a 500-unit order of standard notebooks may require 10-12 days. However, during peak demand periods—such as September-October (UAE National Day preparation) or November-December (year-end corporate gifting)—the same order may require 20-25 days as suppliers manage competing priorities across multiple clients.

The MOQ-timeline relationship: larger orders do not always require proportionally longer production times due to economies of scale in setup and material handling. A 1,000-unit order may only require 2-3 additional days compared to a 500-unit order, making it more time-efficient on a per-unit basis.

Phase 6: Quality Control (2-3 Days)

Professional suppliers conduct multi-stage quality inspections covering printing accuracy, color consistency, binding integrity, and packaging completeness. However, the effectiveness of quality control varies significantly across suppliers. In our experience, suppliers with ISO 9001 certification or equivalent quality management systems demonstrate significantly lower defect rates (typically below 2%) compared to uncertified suppliers (defect rates of 5-10%).

What happens when quality issues are detected: if defects exceed acceptable thresholds (typically 3-5% of total quantity), suppliers must either rework defective items or reproduce the entire batch. This can add 7-14 days to the timeline and may require renegotiation of delivery dates and pricing.

Phase 7: Packaging and Delivery (3-7 Days)

Final packaging and logistics coordination complete the process. Delivery timelines within the UAE vary based on destination: Dubai and Abu Dhabi typically receive next-day delivery, while remote emirates like Fujairah or Ras Al Khaimah may require 2-3 days. For enterprises requiring delivery to multiple locations—such as branch offices across different emirates—logistics coordination can add 3-5 days.

Customs considerations for imported materials: if your supplier sources materials from outside the GCC, customs clearance can add 3-7 days to the timeline. This is particularly relevant for specialized materials like Italian leather or Japanese paper stocks that are not readily available within the UAE.

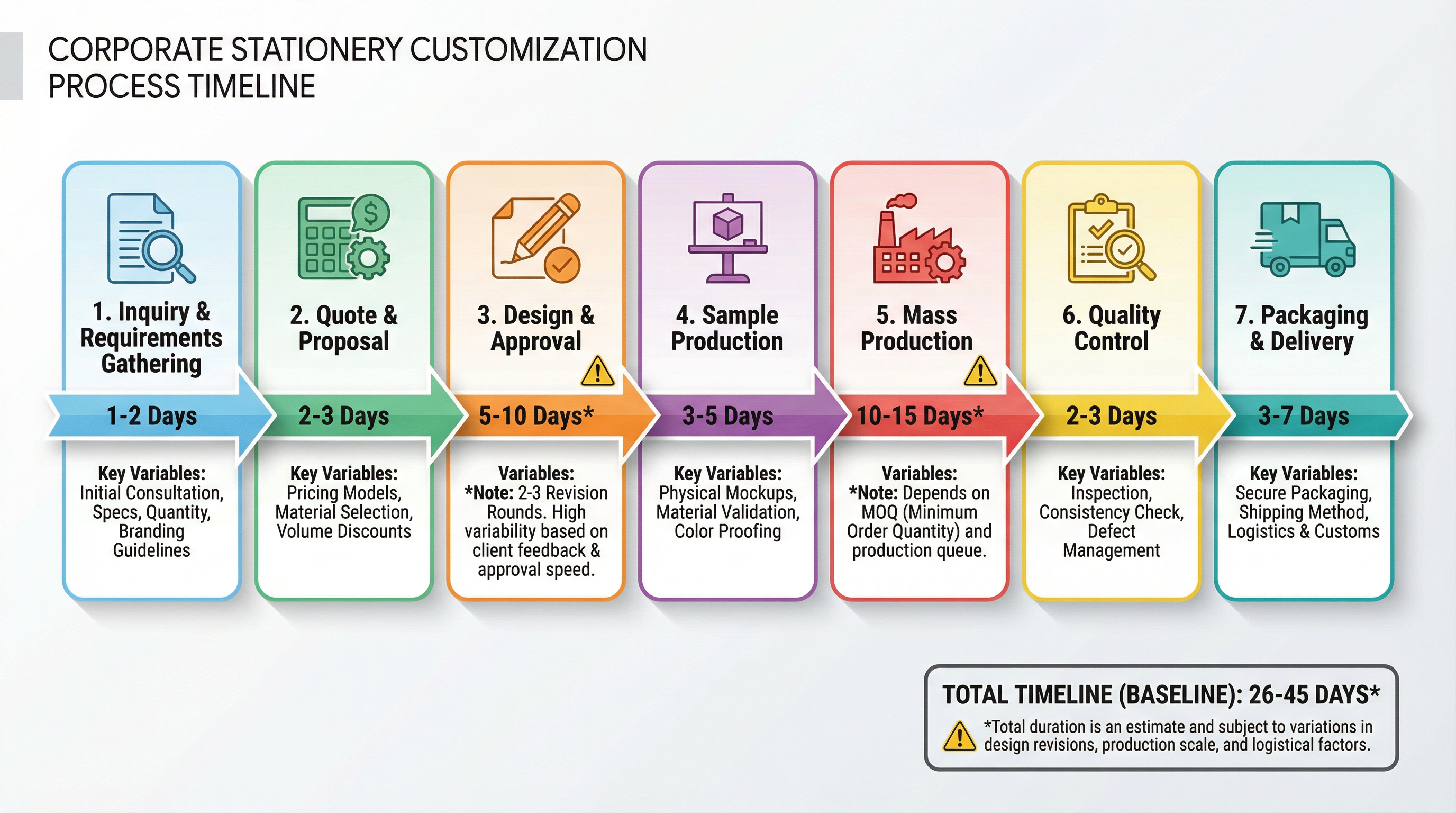

Balancing Design Ambition with Production Reality

One of the most frequent misjudgments we encounter is the assumption that any design concept can be produced within standard timelines and budgets. In practice, design complexity and production feasibility exist in tension, and understanding this relationship is essential for making informed procurement decisions.

The Ideal Zone (Simple Design, Easy Production): Projects in this category—such as logo printing on standard notebooks, embossing on letterheads, or single-color business cards—offer the most favorable combination of low cost (AED 5-15 per unit), short lead time (10-15 days), and low MOQ (100-500 units). These projects leverage suppliers' existing capabilities and material stocks, minimizing setup costs and procurement delays.

Complex but Feasible (Simple Design, Difficult Production): This category includes projects requiring specialized materials—such as vegan leather, recycled paper, or custom paper weights—or advanced production techniques like multi-layer binding or custom die-cutting. While the design itself may be straightforward, production complexity arises from material sourcing and specialized equipment requirements. Expect medium cost (AED 20-40 per unit), medium lead time (20-30 days), and medium MOQ (500-1,000 units).

Challenging Design (Complex Design, Easy Production): Projects featuring intricate visual elements—such as full-color gradient printing, detailed illustrations, or multi-font layouts—fall into this category. Production remains relatively straightforward using standard equipment and materials, but design complexity increases pre-production time for file preparation and color proofing. Typical parameters include medium cost (AED 15-30 per unit), medium lead time (15-25 days), and low MOQ (200-500 units).

High Risk Zone (Complex Design, Difficult Production): Projects combining design complexity with production challenges—such as metallic foil stamping with embossing, laser-cut patterns, or hand-assembled components—require careful risk assessment. These projects demand specialized equipment, skilled labor, and extended production timelines. Expect high cost (AED 50-100+ per unit), long lead time (30-45 days), and high MOQ (1,000+ units). We generally recommend this category only for flagship corporate gifts or high-value client appreciation programs where budget constraints are less critical.

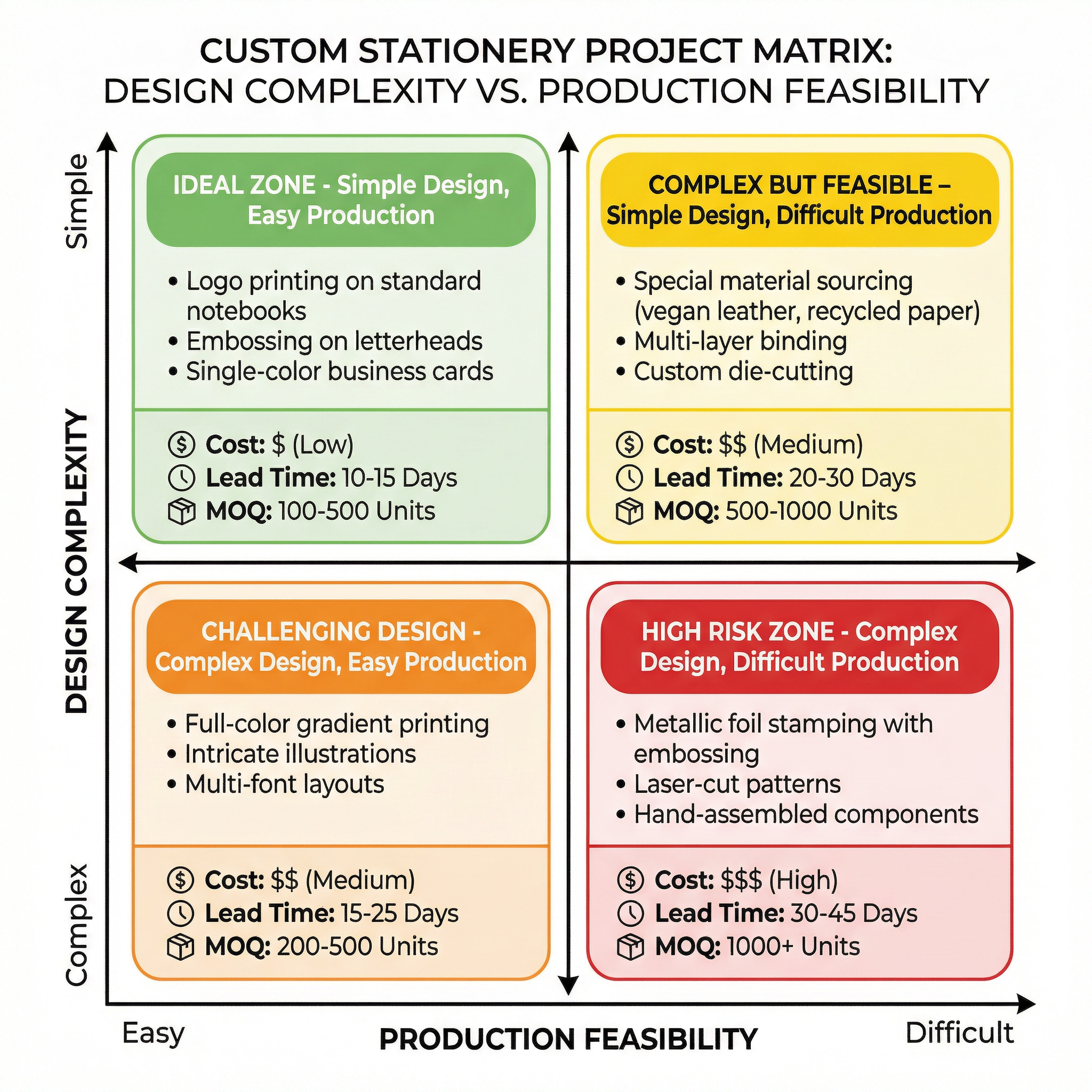

Navigating UAE Seasonal Demand Patterns

Understanding seasonal demand patterns in the UAE market is critical for realistic timeline planning. Unlike Western markets where demand peaks around year-end holidays, the UAE market exhibits distinct patterns driven by cultural events and corporate gifting traditions.

January-February (Normal Capacity): Baseline operations with standard lead times of 25-30 days. This is an optimal window for non-urgent procurement as suppliers have available capacity and can accommodate rush requests if needed.

March-April (Ramadan Preparation): Many suppliers begin reducing working hours in anticipation of Ramadan, causing capacity to drop by approximately 20%. Lead times extend to 35-40 days. Enterprises planning Ramadan corporate gifts should initiate procurement no later than mid-February to ensure timely delivery.

May-June (Ramadan and Eid Al-Fitr): This period represents the most significant capacity constraint of the year. Many suppliers operate at 60% capacity or less due to reduced working hours, and some facilities close entirely for 1-2 weeks during Eid holidays. Lead times can extend to 45-55 days. Critical planning note: orders placed during this period may not be fulfilled until July, making early planning essential for time-sensitive requirements.

July-August (Summer Slowdown): Vacation season impacts both supplier operations and client-side approval workflows. Capacity drops by approximately 15%, extending lead times to 30-35 days. This period is generally suitable for non-urgent procurement but requires buffer time for potential delays.

September-October (Peak Corporate Gifting Season): Preparation for UAE National Day (December 2) drives peak demand. While suppliers operate at 100% capacity, high order volumes mean that production slots fill quickly. Lead times extend to 35-45 days, and we strongly recommend booking production slots 2-3 months in advance during this period.

November (UAE National Day Rush): This is the highest-demand period of the year, with suppliers often overbooked. Lead times can reach 50-60 days, and many suppliers implement priority surcharges of 15-25% for rush orders. Enterprises requiring National Day gifts should initiate procurement no later than early September.

December (Year-End Corporate Gifting): Holiday season impacts both production capacity (down 25% due to staff leave) and logistics operations. Lead times extend to 40-50 days. Additionally, international courier services experience delays due to global holiday volumes, potentially adding 3-5 days to delivery timelines.

Differentiated Strategies for Enterprise Scale

Procurement strategies must be tailored to organizational scale and operational priorities. A one-size-fits-all approach fails to account for the distinct constraints and opportunities facing different enterprise types.

For Startups and SMEs

Budget flexibility is paramount. Smaller enterprises typically operate with tighter cash flow constraints and cannot absorb significant cost overruns. Focus on suppliers offering flexible MOQs (100-300 units) and payment terms that align with your cash flow cycle. Consider ready-to-brand options—such as stock notebooks with custom logo printing—which offer lower MOQs and shorter lead times (7-10 days) compared to fully custom manufacturing.

Speed to market often outweighs perfect customization. For startups establishing brand presence, timely delivery may be more valuable than elaborate customization. Prioritize simple designs in the "Ideal Zone" category that can be produced quickly and cost-effectively, allowing you to iterate based on market feedback rather than committing to large volumes of untested designs.

Supplier relationship building is critical. Establish relationships with 2-3 reliable suppliers who understand your growth trajectory and can scale with you. Smaller suppliers often provide more personalized service and flexibility for growing businesses compared to large-scale manufacturers focused on high-volume orders.

For Large and Multinational Enterprises

Compliance and brand consistency are non-negotiable. Larger enterprises must ensure that all customized stationery adheres to corporate brand guidelines and regulatory requirements. This necessitates working with suppliers who have demonstrated quality management systems (ISO 9001), environmental certifications (ISO 14001), and experience with multinational clients.

Global distribution coordination requires specialized logistics capabilities. If your organization requires delivery to multiple locations across the UAE or broader GCC region, prioritize suppliers with established logistics networks and experience managing multi-location deliveries. This may justify paying a 10-15% premium for suppliers offering comprehensive logistics management.

Volume leverage enables favorable terms. Large enterprises can negotiate better pricing, extended payment terms, and priority production slots by consolidating orders across departments or business units. Consider implementing a centralized procurement function for all stationery requirements to maximize volume leverage.

UAE Market-Specific Considerations

Operating in the UAE market introduces specific considerations that may not be immediately apparent to enterprises accustomed to procurement in other regions.

Cultural sensitivity in corporate gifting: UAE business culture places significant emphasis on relationship-building through thoughtful corporate gifts. However, certain items may be culturally inappropriate—such as leather products for clients who avoid animal-derived materials, or alcohol-related items. When designing corporate gifts, consult with local colleagues or cultural advisors to ensure appropriateness.

VAT and customs documentation: Since the introduction of VAT in the UAE in 2018, enterprises must ensure that all procurement documentation includes proper VAT treatment. For imported materials, customs documentation must clearly identify the country of origin, material composition, and intended use to facilitate smooth customs clearance.

Language considerations: While English is widely used in UAE business contexts, some corporate gifts—particularly those intended for government entities or traditional family businesses—may benefit from Arabic text or bilingual designs. Ensure that your supplier has access to professional Arabic typesetting and translation services to avoid errors that could undermine professionalism.

Logistics infrastructure variations: While Dubai and Abu Dhabi benefit from world-class logistics infrastructure, delivery to remote emirates or free zones may require additional coordination. Confirm with your supplier whether they have experience delivering to your specific location and whether any special access requirements apply.

Common Misjudgments and How to Avoid Them

Based on our experience working with procurement teams across the UAE, we have identified several recurring misjudgments that consistently lead to project delays, cost overruns, or quality issues.

Misjudgment 1: Assuming digital proofs accurately represent physical output. Color rendering on screens differs significantly from printed output, particularly for branded colors that must match specific Pantone references. Always request physical samples for orders exceeding AED 10,000 or involving new suppliers, even if this adds 5-7 days to the timeline.

Misjudgment 2: Underestimating internal approval timelines. Procurement teams often focus on supplier lead times while overlooking their own internal approval workflows. If your organization requires sign-off from multiple stakeholders—such as brand management, legal, and finance—factor in 5-10 days for internal approvals when planning timelines.

Misjudgment 3: Treating all suppliers as interchangeable. Supplier capabilities vary significantly in terms of material sourcing, production techniques, quality control, and logistics coordination. A supplier excelling at high-volume, simple designs may lack the capabilities for complex, low-volume projects. Evaluate suppliers based on their demonstrated experience with projects similar to yours.

Misjudgment 4: Prioritizing price over total cost of ownership. The lowest-quoted price may not represent the best value when factoring in quality risk, delivery reliability, and post-delivery support. A supplier quoting 20% lower may have higher defect rates, requiring reorders that ultimately cost more than working with a higher-priced but more reliable supplier.

Misjudgment 5: Failing to plan for seasonal capacity constraints. As illustrated in our seasonal calendar analysis, lead times can double during peak periods like Ramadan or UAE National Day preparation. Enterprises that fail to account for these patterns consistently experience delivery delays. Build a procurement calendar that anticipates these constraints and initiates orders well in advance of critical deadlines.

Misjudgment 6: Assuming design changes have minimal impact. Even minor design modifications—such as changing a Pantone color or adjusting logo placement—can trigger production resets if communicated after sample approval. Finalize all design elements before approving samples to avoid delays and additional costs.

Practical Decision Framework for Supplier Selection

Selecting the right supplier is perhaps the most critical decision in the customization process. We recommend evaluating potential suppliers across five key dimensions:

1. Production Capability Alignment: Does the supplier's core competency align with your project requirements? A supplier specializing in high-volume, simple designs may struggle with low-volume, complex projects requiring specialized techniques. Request portfolio examples demonstrating experience with projects similar to yours in terms of design complexity, materials, and order volume.

2. Quality Management Systems: Does the supplier have documented quality control processes and relevant certifications? Suppliers with ISO 9001 certification or equivalent quality management systems typically demonstrate lower defect rates and more consistent output. Request information about their inspection procedures, acceptable quality limits, and policies for handling defective items.

3. Material Sourcing Transparency: Can the supplier clearly explain their material sourcing process and provide documentation of material origin and compliance? This is particularly important for enterprises with sustainability commitments or regulatory requirements. Suppliers should be able to provide material certifications, country of origin documentation, and information about environmental compliance.

4. Communication and Responsiveness: How quickly and clearly does the supplier respond to inquiries? Effective communication is essential for managing design revisions, addressing production issues, and coordinating delivery logistics. Evaluate suppliers based on their responsiveness during the inquiry phase, as this typically reflects their ongoing communication standards.

5. Financial Stability and Payment Terms: Does the supplier have the financial stability to manage your order without cash flow constraints? Suppliers requiring large upfront deposits (70-100%) may be experiencing cash flow challenges that could impact their ability to complete your order reliably. Prefer suppliers offering balanced payment terms (30-50% deposit, balance on delivery) as this indicates financial stability.

Next Steps: From Understanding to Action

Understanding the customization process is only valuable if it translates into better procurement outcomes. We recommend the following action steps for enterprises planning custom stationery procurement in the UAE:

Immediate actions: Develop a procurement calendar that maps your stationery requirements against UAE seasonal patterns, identifying optimal ordering windows. Audit your current supplier relationships to ensure they align with the five evaluation criteria outlined above. Document your internal approval workflows to identify bottlenecks that could delay project timelines.

Short-term actions: Request portfolio examples and client references from potential suppliers to validate their capabilities. Develop standardized design templates and brand guidelines that can be provided to suppliers during the inquiry phase, reducing design revision rounds. Establish relationships with 2-3 backup suppliers to mitigate risk if your primary supplier experiences capacity constraints.

Long-term actions: Consider consolidating stationery procurement across departments to maximize volume leverage and negotiate better terms. Implement a supplier performance tracking system to monitor quality, delivery reliability, and responsiveness over time. Build institutional knowledge by documenting lessons learned from each procurement cycle.

For enterprises seeking expert guidance on navigating the custom stationery procurement process in the UAE, partnering with an experienced local supplier can significantly reduce risk and improve outcomes. Explore our custom stationery solutions to learn how we support UAE enterprises with end-to-end procurement management, from design consultation to final delivery.

Related Articles

Finishing Process Approval vs. Production Finishing Calibration Lock Timing Gap in Custom Stationery Procurement

Why procurement teams approve sample finishing quality expecting identical production results, but factories require 13-20 days of invisible calibration to translate manually-crafted sample finishing into automated production parameters, creating systematic delivery gaps through equipment translation, bulk foil procurement, and multi-trial parameter optimization.

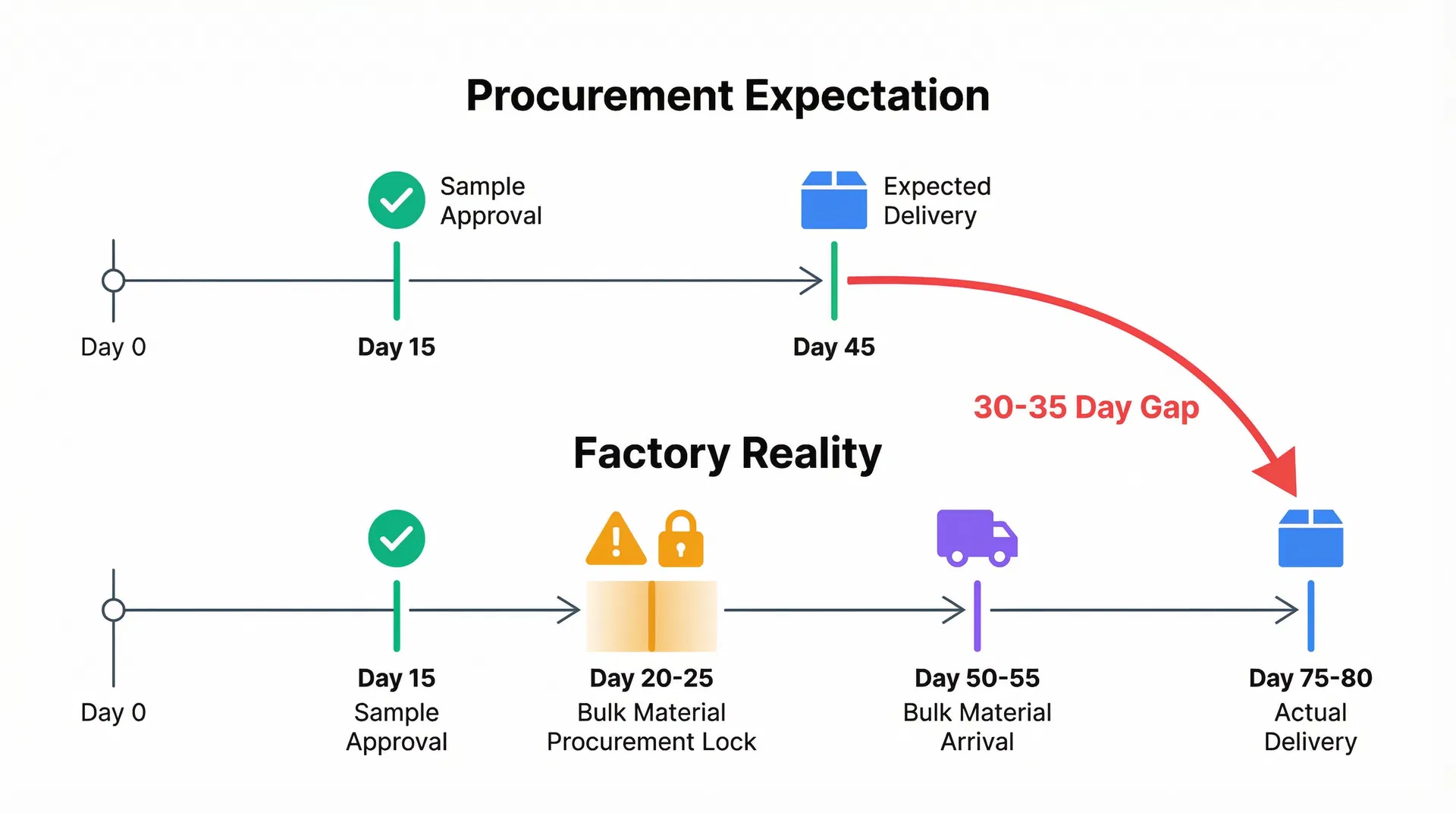

Sample Approval vs. Bulk Material Procurement Lock Timing Gap in Custom Stationery Procurement

Why procurement teams approve samples expecting bulk production with identical materials, but factories lock bulk material procurement 5-10 days later using different suppliers with MOQ constraints, creating 30-35 day delivery gaps through invisible supplier switching and specification adjustments.

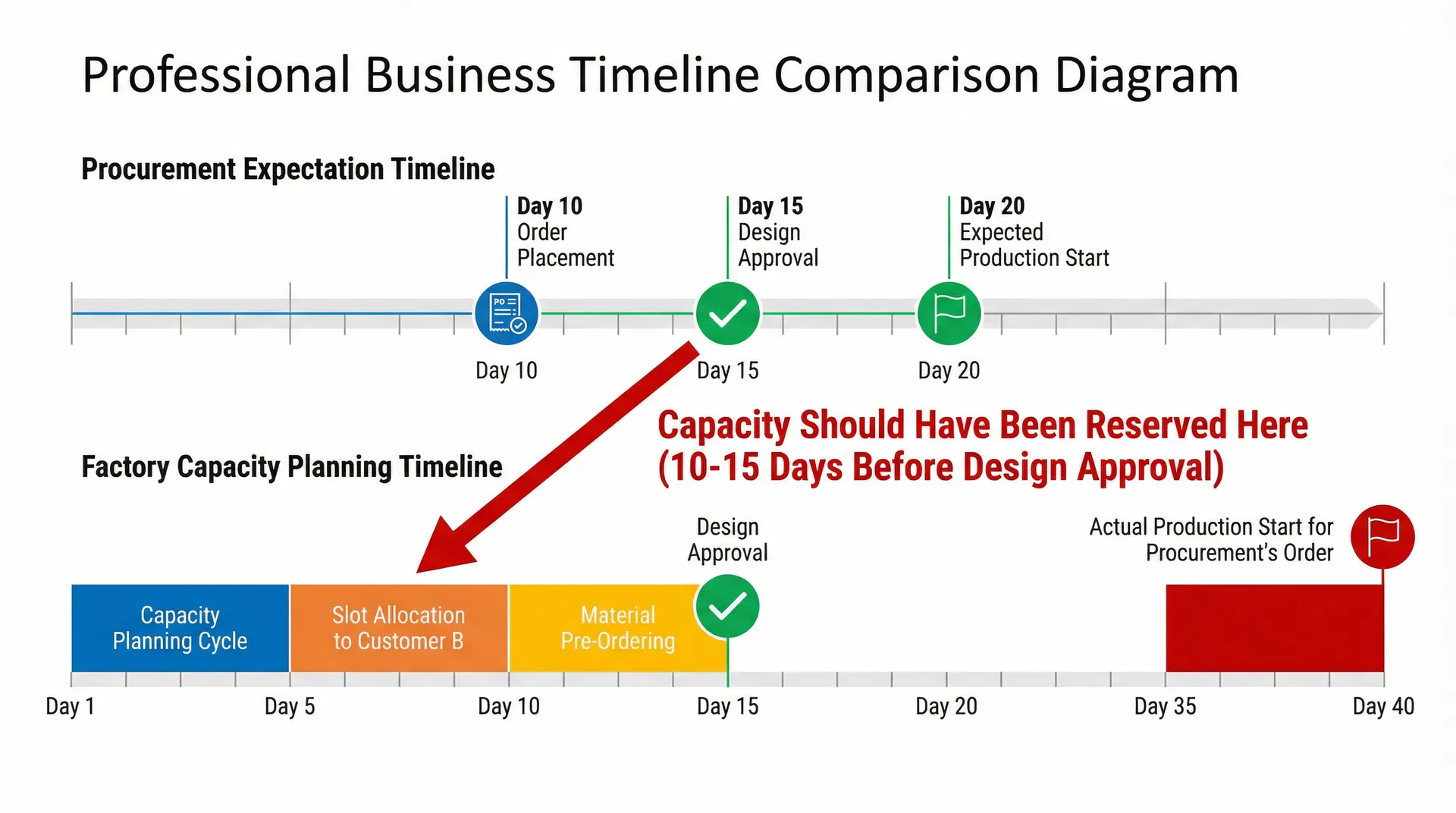

Capacity Reservation vs. Design Approval Timing Gap in Custom Stationery Procurement

Why procurement teams approve design expecting immediate production start, but factories lock capacity slots 10-15 days before design approval through capacity planning cycles, creating backward timing misalignment where capacity should have been reserved before design was finalized.