Sample Approval vs. Bulk Material Procurement Lock Timing Gap in Custom Stationery Procurement

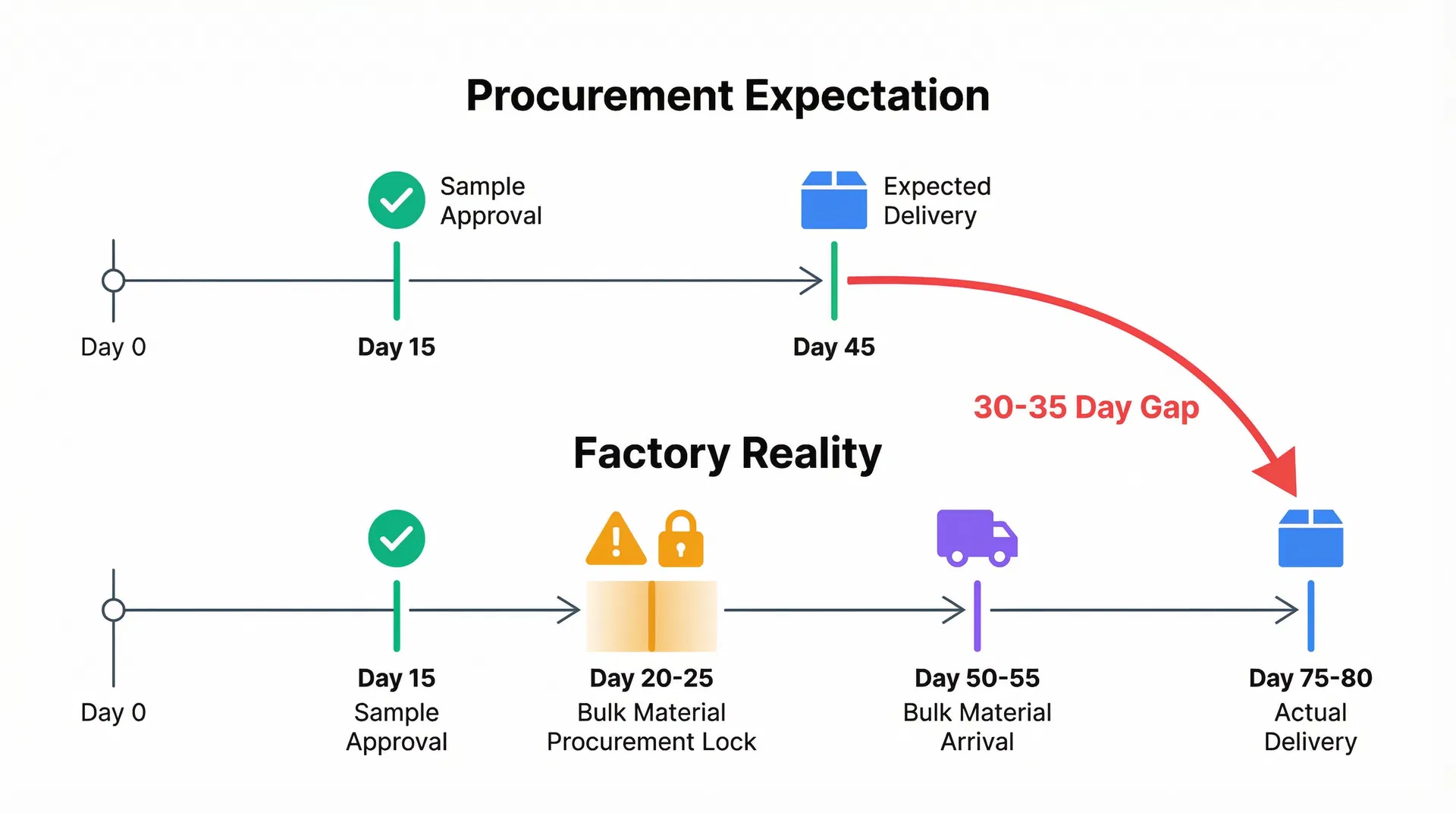

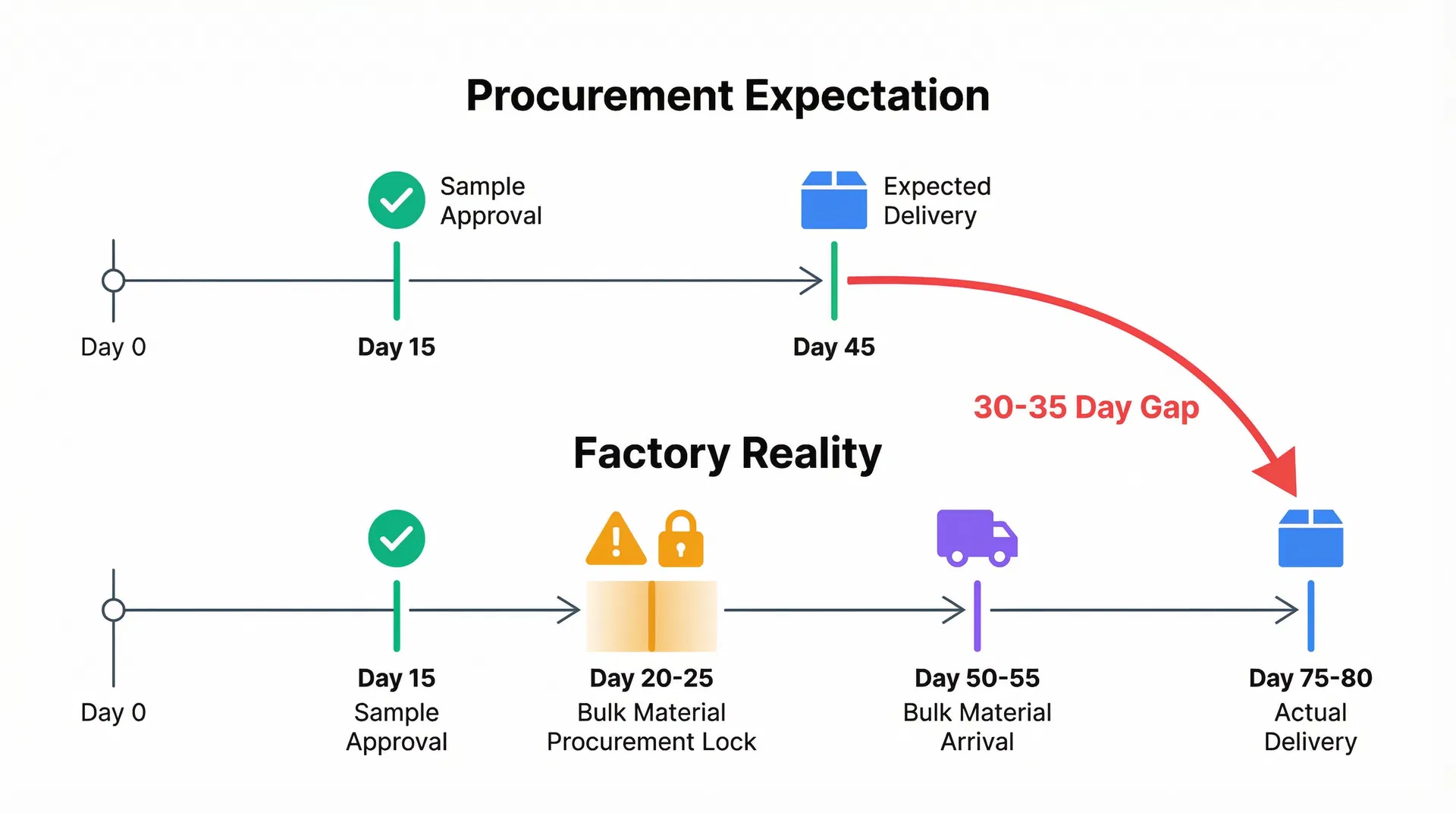

When procurement teams receive sample approval from stakeholders, the natural assumption is that production materials have been locked and manufacturing timelines can begin counting from that approval date. In practice, this is often where customization process decisions start to be misjudged. The sample approval event—typically occurring around Day 15 in a standard timeline—represents buyer confirmation of aesthetic and functional specifications, but it does not represent factory confirmation of bulk material sourcing. The gap between these two events, though seemingly minor at 5-10 days, introduces a structural misalignment that frequently extends delivery timelines by 30-35 days beyond procurement expectations.

The core issue stems from a fundamental difference in material sourcing strategies between sample production and bulk production. When factories produce samples for approval, they typically source small quantities—often 50-100 meters of material for a leather notebook order, or 200-300 sheets for a custom stationery set—from local suppliers who can deliver within 2-3 days. These sample-stage suppliers operate with minimal or no minimum order quantity (MOQ) requirements, allowing factories to procure exactly the amount needed for 10-15 sample units. The materials arrive quickly, samples are produced with careful attention, and the approval process proceeds smoothly. Procurement teams review these samples, confirm specifications, and issue approval on Day 15, believing that the approved materials are now locked for bulk production.

However, the factory's bulk material procurement operates under entirely different constraints. For a 5,000-unit order of custom leather notebooks, the factory requires approximately 5,000-7,000 meters of leather material—a quantity that local sample suppliers cannot provide. Instead, the factory must source from specialized mills or tanneries that operate with strict MOQ requirements, typically 3,000-5,000 meters per color batch. These bulk suppliers require 4-6 weeks lead time from order placement to delivery, as they must schedule production runs, allocate dyeing capacity, and coordinate logistics for large-volume shipments. The factory cannot place this bulk material order until sample approval is received on Day 15, because any design changes during the approval process could invalidate the material specifications.

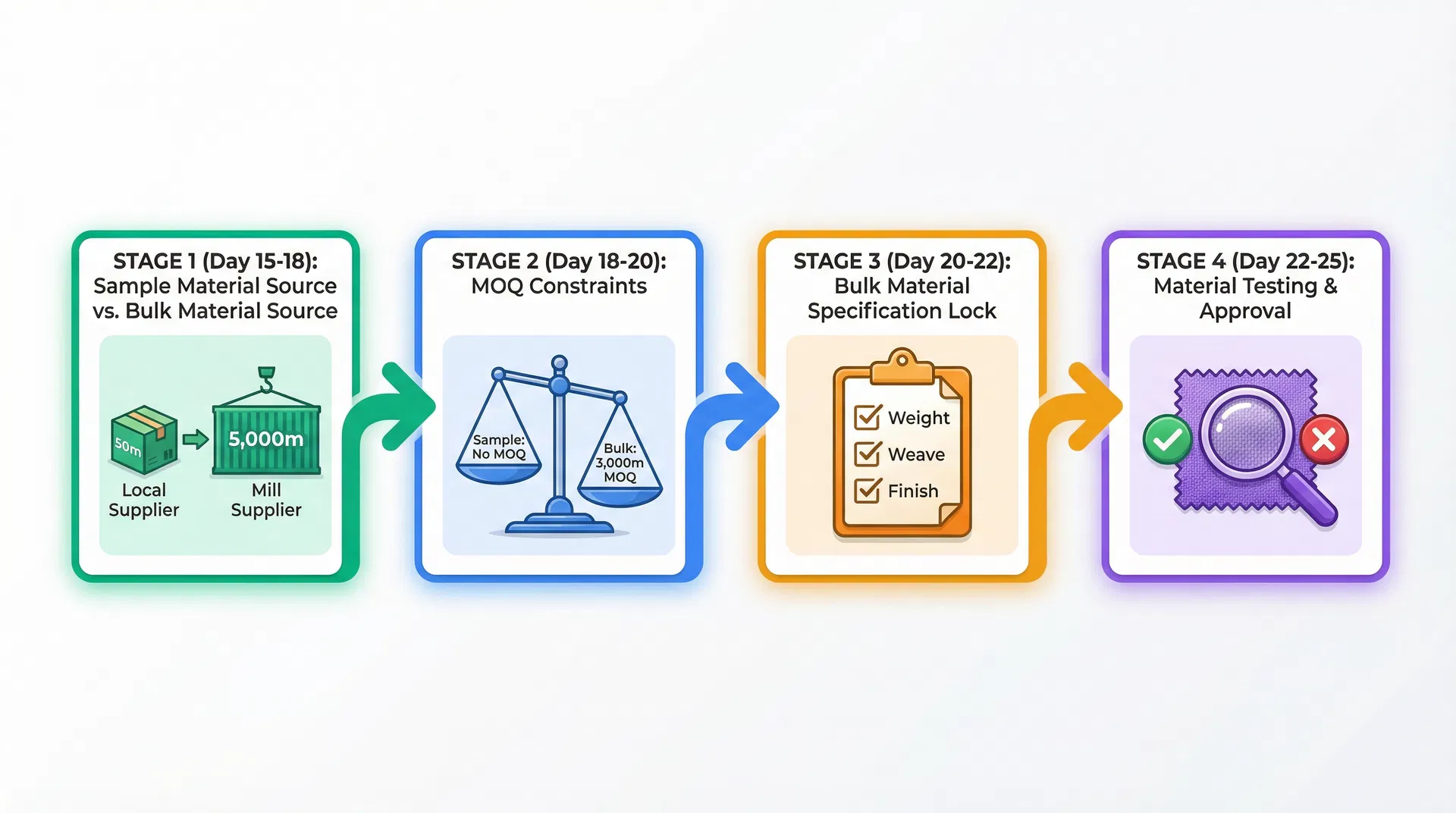

Between Day 15 (sample approval) and Day 20-25 (bulk material procurement lock), the factory executes a four-stage procurement process that procurement teams rarely observe. The first stage involves identifying bulk material suppliers who can meet both the quantity requirements and the specification match. The sample material—sourced from a local supplier in Italy—may have specific characteristics (grain pattern, thickness, dye absorption rate) that the bulk supplier in Turkey cannot perfectly replicate. The factory must evaluate whether the bulk supplier's material falls within acceptable tolerance ranges, or whether specification adjustments are necessary. This evaluation typically requires 2-3 days of technical assessment and supplier negotiation.

The second stage addresses MOQ constraints and their impact on material specifications. The bulk supplier's 3,000-meter MOQ for Pantone 2935 C royal blue leather may force the factory to order a larger quantity than needed for the current 5,000-unit order, creating inventory holding costs. Alternatively, the supplier may offer a "close match" color from an existing production run with a lower MOQ, but this requires buyer approval of a material swatch that differs slightly from the approved sample. The factory must decide whether to proceed with the exact match (higher cost, longer lead time) or propose the close match (lower cost, faster delivery, but requires re-approval). This decision-making process adds 1-2 days to the procurement timeline.

The third stage locks bulk material specifications based on the chosen supplier's capabilities. Even if the factory commits to an exact color match, the bulk supplier's leather may have different technical specifications than the sample material. The sample leather (1.2mm thickness, semi-aniline finish, soft temper) may need to be adjusted to the bulk supplier's standard offerings (1.0-1.4mm thickness range, aniline finish, medium temper). The factory must update internal production specifications to account for these differences, recalculate material yield rates (thinner leather = higher waste percentage), and adjust tooling parameters (embossing pressure, foil stamping temperature) accordingly. This specification lock process requires 2-3 days of engineering review and documentation updates.

The fourth stage involves material testing and approval, which introduces the highest risk of timeline extension. Once the factory locks bulk material specifications on Day 20-22, the bulk supplier ships a material swatch (typically 1-2 meters) for buyer approval before committing to the full 3,000-5,000 meter production run. This swatch arrives at the buyer's office on Day 23-24, where it undergoes comparison against the approved sample. If the buyer identifies any discrepancies—color variation (Delta E = 2.5 instead of expected 1.0), texture difference (grain pattern less pronounced), or hand feel variation (slightly stiffer temper)—the factory must restart the supplier evaluation process, adding 7-14 days to the timeline. Even if the buyer approves the swatch immediately, the bulk supplier requires 4-6 weeks to produce and deliver the full material quantity, pushing material arrival to Day 50-55.

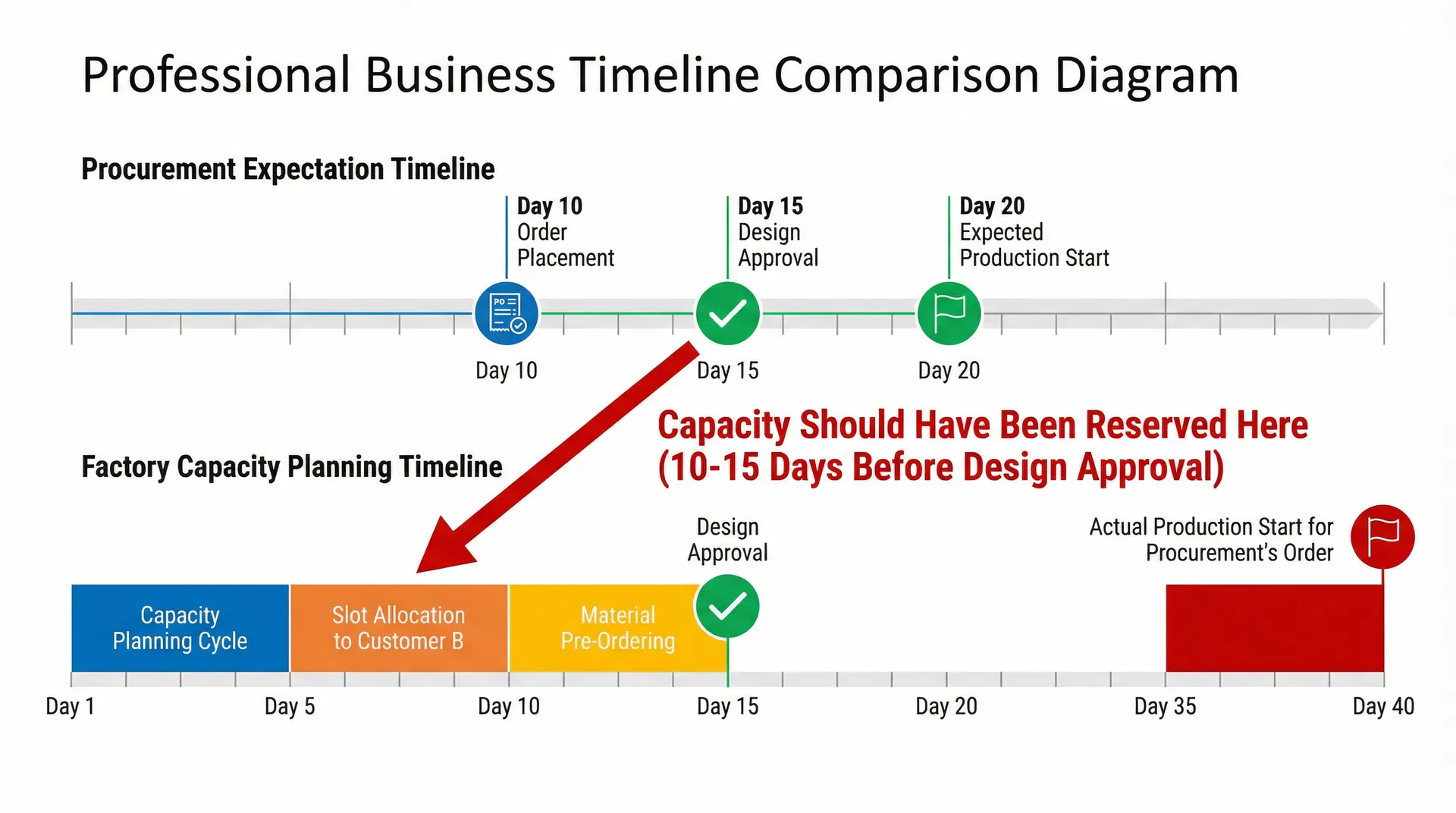

This 30-35 day gap between procurement's expected delivery (Day 45, calculated as 30 days from sample approval on Day 15) and factory's actual delivery (Day 75-80, calculated as 25 days production time from Day 50-55 material arrival) creates persistent tension in customization workflows. Procurement teams interpret the gap as "factory delay" or "poor planning," while factories view it as the natural consequence of bulk material procurement constraints that were invisible during the sample approval stage. The misalignment is structural rather than operational—procurement's timeline calculation begins at sample approval, while the factory's timeline calculation begins at bulk material arrival, and the 30-35 day procurement window between these two events is rarely acknowledged in delivery commitments.

The challenge intensifies when buyers request material changes after sample approval. A request on Day 18 to change the leather color from Pantone 2935 C to Pantone 2738 C—seemingly a minor adjustment—invalidates the bulk material procurement process that began on Day 16. The factory must restart supplier evaluation, MOQ negotiation, specification lock, and material testing, pushing the bulk material procurement lock from Day 20-25 to Day 33-38, and extending final delivery by an additional 13-18 days. From the factory's perspective, the change request arrived before bulk material procurement lock, so it could be accommodated without production disruption. From procurement's perspective, the change request arrived only 3 days after sample approval, so it should have minimal timeline impact. Neither perspective is incorrect—they are simply measuring from different reference points in the material procurement timeline.

For custom stationery and corporate gift orders, this sample-to-bulk material transition represents one of the highest-risk timeline variables. A 500-unit order of embossed leather journals may use sample materials costing $8-12 per meter (premium Italian leather, small quantity, fast delivery) but require bulk materials costing $4-6 per meter (Turkish leather, large quantity, 6-week lead time). The approved sample's aesthetic quality—grain pattern, color depth, hand feel—was achieved with the premium Italian leather, but the bulk production will use the Turkish leather that offers 85-90% aesthetic match at 50% material cost. Procurement teams rarely understand that "sample approval" does not guarantee "bulk material match," because the economic constraints of bulk procurement (MOQ requirements, lead time, cost targets) often necessitate supplier changes that introduce subtle but perceptible material variations.

The most effective mitigation strategy involves shifting the material approval checkpoint from post-sample to pre-sample. Instead of producing samples with readily available local materials and then searching for bulk suppliers who can match those materials, factories should identify bulk suppliers first, procure bulk material swatches, produce samples using those bulk materials, and then submit for approval. This approach adds 7-10 days to the sample production timeline (Day 5-15 instead of Day 8-12) but eliminates the 30-35 day delivery extension caused by sample-to-bulk material mismatches. Procurement teams receive samples that accurately represent bulk production materials, and approval on Day 15 genuinely locks both aesthetic specifications and material sourcing, allowing production to begin immediately upon bulk material arrival on Day 45-50 (4-6 weeks from Day 15 approval).

However, this pre-sample bulk material procurement strategy requires procurement teams to commit to order quantities and specifications earlier in the timeline—typically Day 1-5, before design finalization. Many buyers resist this early commitment, preferring to maintain flexibility through the sample approval stage. The result is a structural trade-off: early material commitment enables accurate delivery timelines but reduces design flexibility, while late material commitment preserves design flexibility but introduces 30-35 day delivery uncertainty. Neither approach is universally superior—the optimal choice depends on whether the specific project prioritizes timeline predictability or design iteration capacity.

For procurement teams managing custom stationery orders, understanding the sample approval versus bulk material procurement lock timing gap requires recognizing that "approval" is not a singular event but a multi-stage process. Sample approval (Day 15) confirms aesthetic and functional specifications. Bulk material procurement lock (Day 20-25) confirms supplier selection and material specifications. Bulk material arrival (Day 50-55) confirms physical material availability. Production start (Day 50-55) confirms manufacturing timeline initiation. Each of these events represents a distinct commitment point, and conflating them—particularly conflating sample approval with bulk material procurement lock—creates the 30-35 day delivery gap that procurement teams interpret as factory delay but factories interpret as standard material procurement lead time.

The gap is not a failure of factory planning or procurement communication. It is an inherent characteristic of customization processes that require material sourcing decisions to be made after aesthetic approval rather than before. Until procurement teams adjust their timeline calculations to account for the 5-10 day bulk material procurement lock delay and the subsequent 4-6 week bulk material lead time, the 30-35 day delivery gap will persist as a recurring source of misalignment between buyer expectations and factory capabilities. The question is not whether this gap can be eliminated—it cannot, given the economic constraints of bulk material procurement—but whether both parties can acknowledge its existence and incorporate it into their respective timeline planning frameworks.